Development Trend of Inkjet Printing Technology and Additive Manufacturing

Today, a piece of paper and a flat-screen TV can all be put together to talk about manufacturing: they can all be “printed” using inkjet printheads. Inkjet printers were first invented by IBM in the 1970s as an alternative dot matrix printer. However, IBM researchers certainly did not expect that their invention would one day become a key element in the manufacture of televisions, electronic components and solar cells. About a decade ago, ink jet printers were gradually used to support the above-mentioned three applications in order to meet the requirements for the rapid and cost-effective manufacture of printed circuits and the efficient deposition of ultra-thin wires on solar cells.

Drop-on-demand piezoelectric printheads are best suited for the deposition of picoliter-scale inks on a time-, position-, and high-frequency basis. Compared to thermal ink-jet printing, which is widely used for consumer and office printing, piezoelectric printheads are widely used in industrial printing because of their better adaptability and longer lifespan in harsh environments. In addition, piezoelectric print heads can support more ink selections such as water, solvent, and UV curable types.

Inkjet printing as a manufacturing technology, after long-term research and development, in the field of display (smartphones, televisions, etc.) OLED thin film packaging, obtained the first large-scale manufacturing applications. OLED technology is driving the development of the display market. It not only brings market opportunities for inkjet printing, but it is also promoting inkjet printing technology as a popular new electronic and microelectronic manufacturing process. Kateeva is an American company dedicated to manufacturing inkjet printers for OLED displays and is one of the leading manufacturers of inkjet printing technology. After becoming the first company to achieve mass production of OLED thin film packages, Kateeva is now working hard to achieve RGB OLED material deposition for TV display manufacturing using inkjet printing. LG is currently using Kateeva’s printer for trial production.

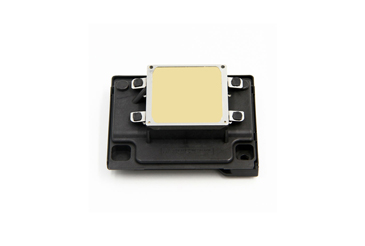

The rise of the wearable market increasingly requires devices that are miniaturized and close to human skin, which brings market opportunities for flexible printed electronics. Inkjet printing technology will replace the expensive lithography process using mask technology to achieve the deposition of conductive lines on demand. Inkjet printing technology exhibits stable performance improvements in deposition accuracy, high resolution printing, and drop control. Inkjet printheads are one of the key components of inkjet printers and they are becoming more and more sophisticated, requiring deep technical and experience accumulation.

In order to increase the printing speed, inkjet printers generally integrate multiple inkjet heads in parallel. It is worth noting that inkjet head positioning and inkjet control are critical for target applications and printer manufacturers. The quality of inkjet printheads has been improved through the use of MEMS technology and thin-film PZT (lead zirconate titanate) materials, helping them meet the application needs of electronic products.

Can you create a complete electronic device using inkjet printing technology? The answer is yes, but it is limited to prototype printing applications. Now using an inkjet printer, using 3D inkjet printing can make almost all types of PCB boards. Nano-Dimension, a developer of 3D printing equipment solutions, launched the Dragongfly 2020 at the end of 2017. This product uses Konica Minolta’s inkjet print heads. In large-scale applications, inkjet printing is still one of the key processes in the manufacturing process.

2023 inkjet print head market will exceed $31 million

The use of inkjet printing technology for functional printing has created new market opportunities for inkjet printhead manufacturers. With the continuous advancement of the “Industry 4.0” digital revolution, the integrated inkjet printheads in industrial printing equipment are expected to grow to over US$31 million by 2023, with a compound annual growth rate of 30.3% over the 2017-2023 period. Major players in this field include Konica Minolta, Fujifilm DimaTIx, Océ-Canon and Xaar. The market outlook is promising, and other piezoelectric inkjet print head manufacturers are also very active now, which means that competition for market share will become increasingly fierce.

At present, R&D applications still account for a major share of the purchase volume of inkjet printers, accounting for approximately 93% of total shipments. The large-scale manufacturing applications of inkjet printing, OLED thin film packaging as a beginning, has just emerged. However, the market is now responding with optimism. The industry has shown great interest in RGB deposition, PCB and flexible electronic manufacturing inkjet printing applications.

Ink: Another Key Factor of Inkjet Printing Process

The key “golden triangle” in the inkjet printing process includes: inkjet print heads, inks, and substrates. There are a variety of ink materials available for ink jet printing, such as conductive inks, metallic inks, protective layer inks, and OLED material inks. Therefore, functional ink formulations are an important challenge for manufacturing applications. This report estimates the demand for ink for inkjet printing applications in the areas of functional manufacturing and additive manufacturing. Inkjet printheads have a limited viscosity for inks and indicate limited tension latitude and can only be optimized for certain types of inkjet printheads.